Ultimate XL Nappy Disposal Bundle with 18 Refills

Bundle & Save 40%

Subscription orders can be cancelled at anytime. Free delivery on all subsequent subscription orders. Find out more about subscriptions.

They’re easy and fuss free

Your products are automatically sent to you

You save up to 10% when you sign up for a subscription

You can cancel at any time

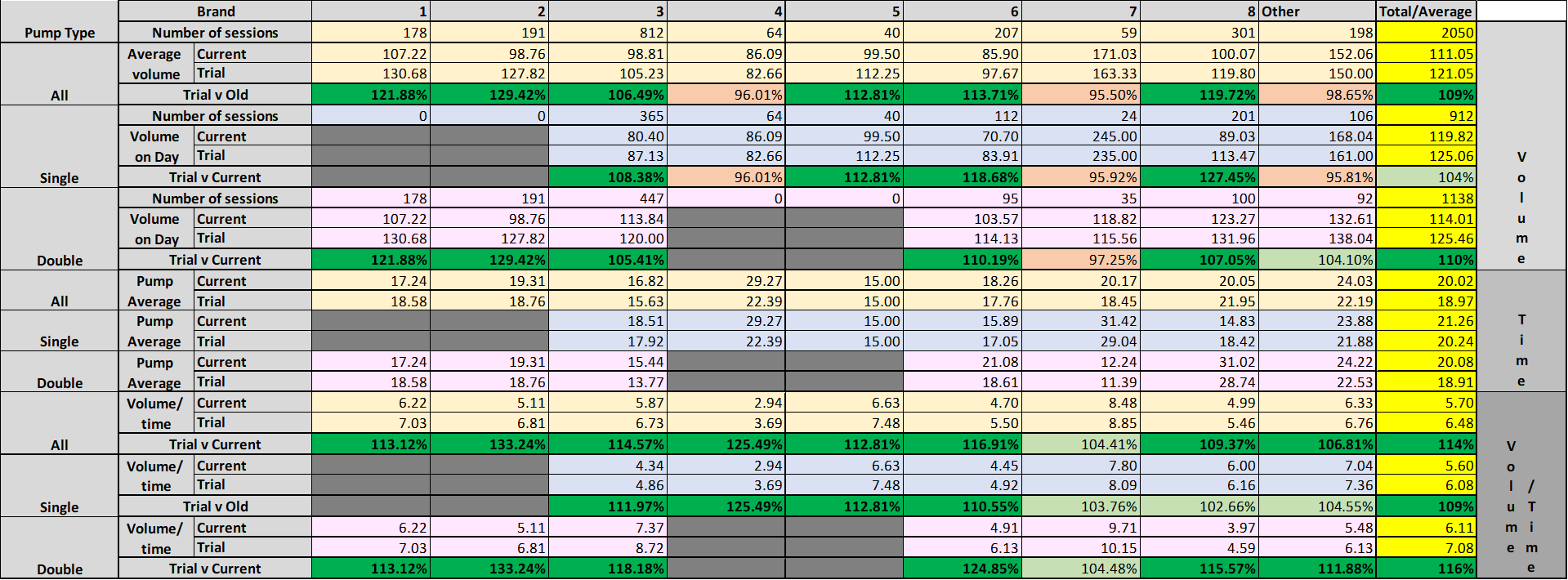

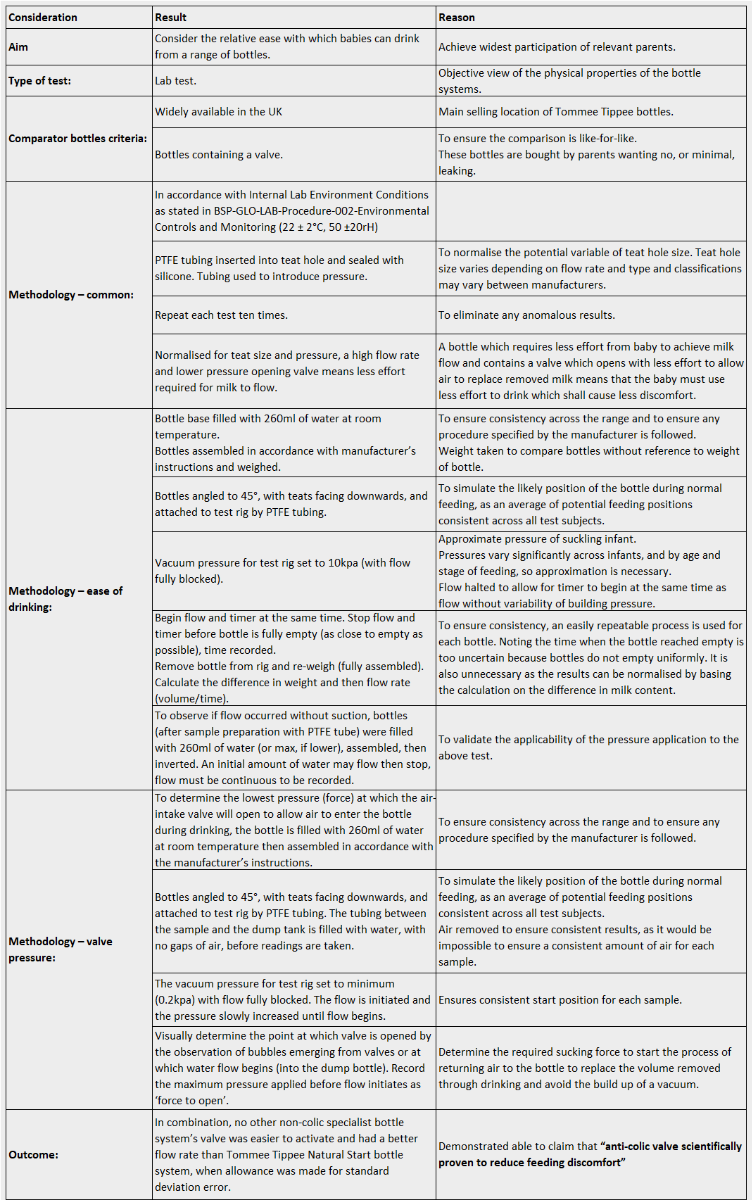

| Consideration | Result | Reason |

| Type of trial/test | In-home consumer test | Closest to real-life experience. |

| Date of trial/test | Jun-22 | Revised product launch. |

| Conducted by | Mum’s Views Ltd | Independent, reduce risk of bias. |

| Participants | 100 UK mothers | Sufficient number to support conclusions, subject to practical considerations including recruitment and availability of trial pumps. |

| Selection Criteria | Current users of double and single electric breast pumps; | To enable comparison between trial pump and rest of market. |

| Expressing a minimum of two sessions per day; | To ensure sufficient data points for meaningful conclusions. | |

| 59 using double pumps, 41 using single pumps; | In line with wider market use. | |

| Key demographics (social classification, first time mothers, subsequent mothers and thier current pump brand) all matched to wider UK market. | To ensure results are representative of the wider UK market. | |

| Methodology | Each session measures volume, length of session, pump setting (let-down/pump), time of session and notable exceptions (such as interrupted routine); | Full data points to be able to fully analyse and to identify any abnormal conditions which may affect the conclusions. |

| Four days expressing with current pump,measuring/recording; then | Capture comparison data in controlled circumstances. | |

| One day with trial pump, without measuring; then | Avoid unfamiliarity affecting the results. | |

| Four days with trial pump,measuring/recording. | Capture trial pump data. | |

| Support | E-mail and telephone support available to all participants. | Ensure accuracy and to maintain participation. |

| Conclusions | Trial pump produced more milk for a fixed period of time than current pumps (average amounts, 114% more for all, 109% more for single pump users, 116% for double pump users), and when compared to all brands (average amounts, between 104.41% more and 133.24% more). | Trial pump is more efficient (defined as more milk for a given time), than the rest of the market. "More milk in less time" |

| Trial pump produced more milk than current pumps (average amounts, 109% more for all, 104% more for single pump users, 110% for double pump users), but not when compared to all brands (average amounts, two brands and miscellaneous pumps produced more per session). | Trial pump helps to produce more milk than most of the market, but not all. |

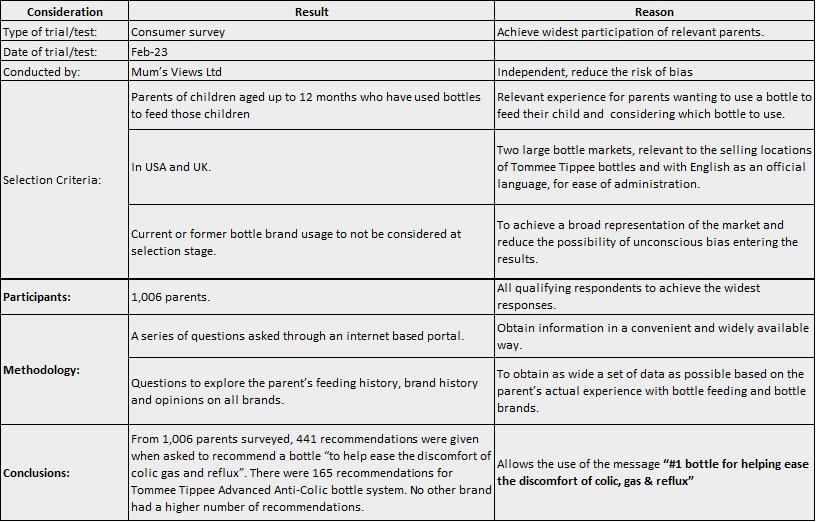

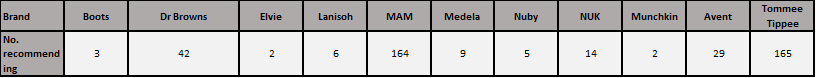

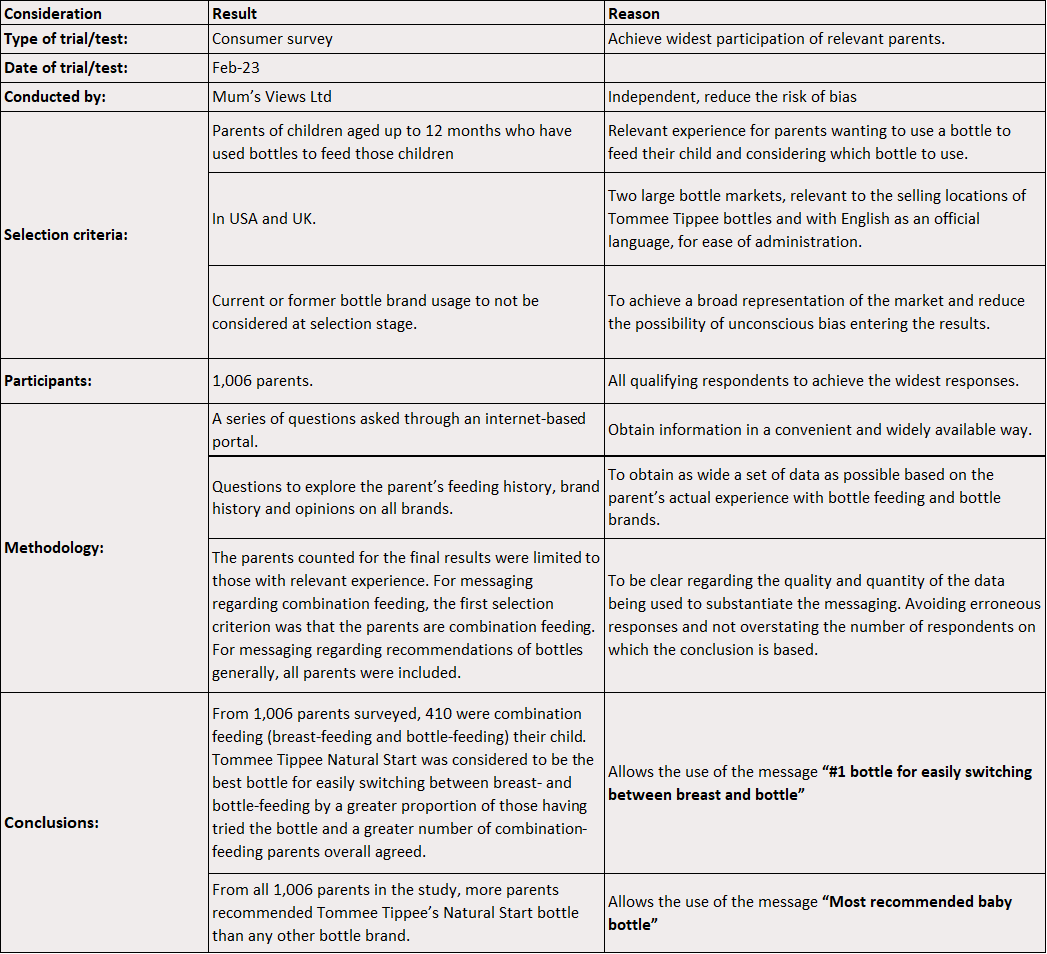

“Most recommended baby bottle” and “#1 bottle for easily switching between breast and bottle”

Parents who combination feed (410), asked what they consider to be the best bottle for easily switching between bottle feeding and breast feeding:

All parents surveyed (1,006), when asked which baby bottles they would recommend:

![]()

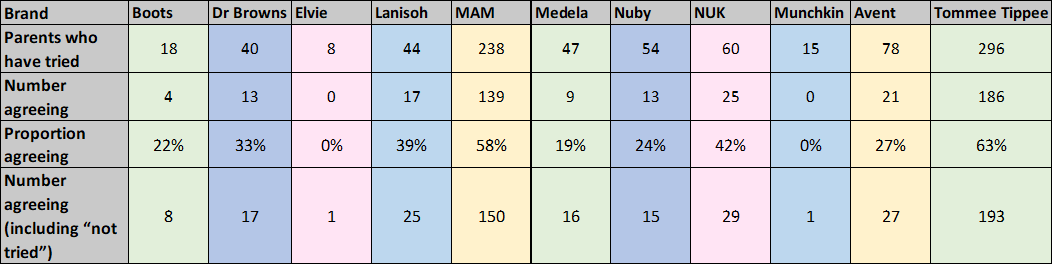

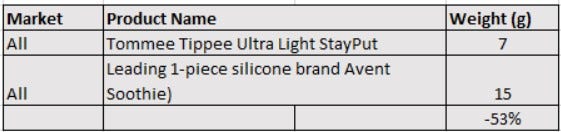

Substantiation of following claims relating to our Ultra Light Soother / Pacifier

The lightest one-piece silicone soother / pacifier

50% lighter than leading one-piece silicone brand

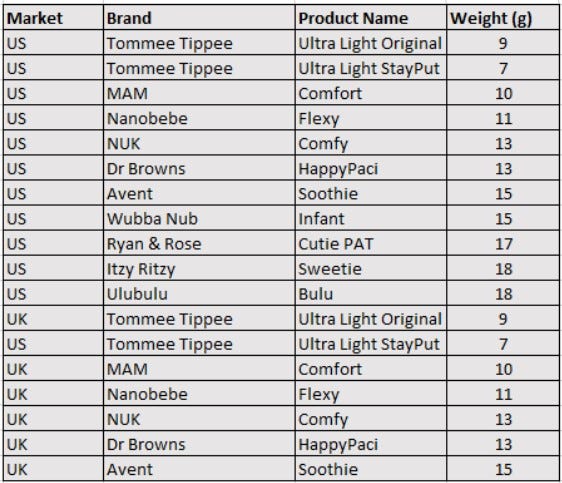

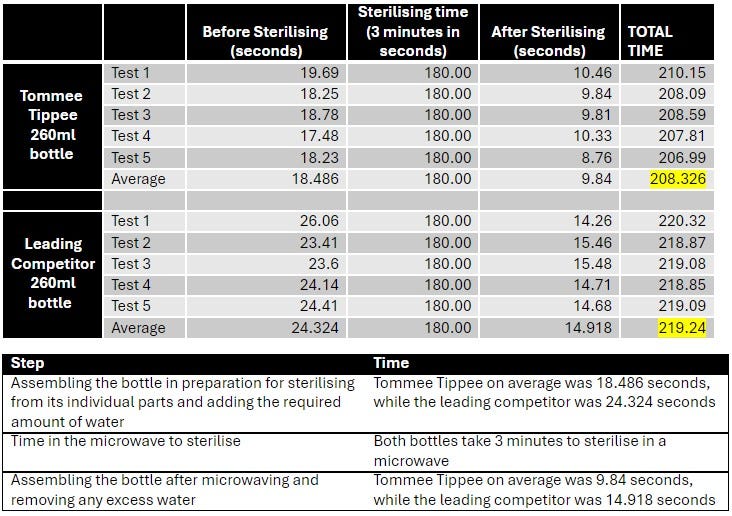

Both compared products are 260ml baby bottles with a self-sterilising function using a microwave.

The test involved assembling the 260ml bottle in line with the instructions, adding the amount of water stated in the instructions for sterilising, and microwaving for the time stated in the instructions. Comparison of the self-sterilising feature was prepared in accordance with instructions across 5 tests, and an average taken as per the table below -

Test Date: 31/10/2024

Equipment

Methodology:

Test Results:

Conclusion:

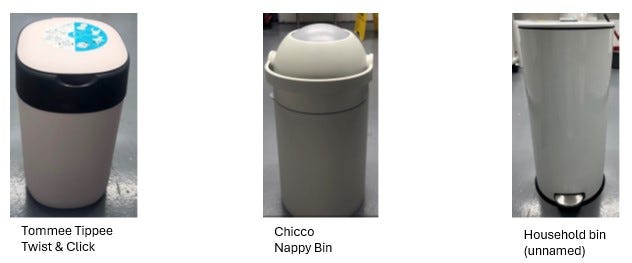

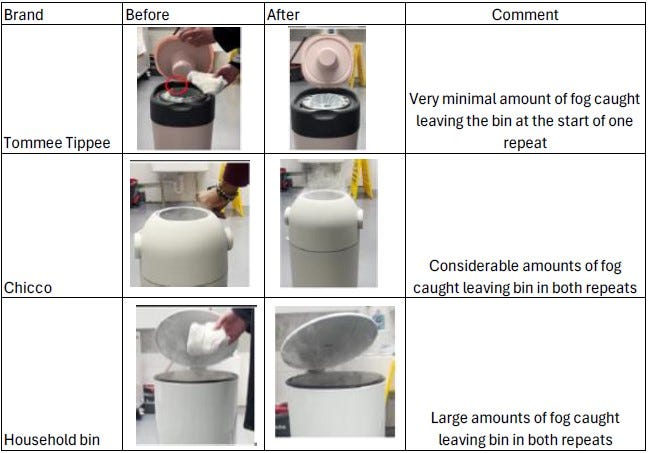

1.)Tommee Tippee Twist & Click had a very minimal amount of fog caught leaving it on during one repetition of the test.

2.) This was followed by the Chicco, which had considerable amounts of fog caught leaving the bin in all repeats.

3.) Household bin had all large amounts of fog leaving the bin in every repeat.

Test date: 21/03/2025

Methodology:

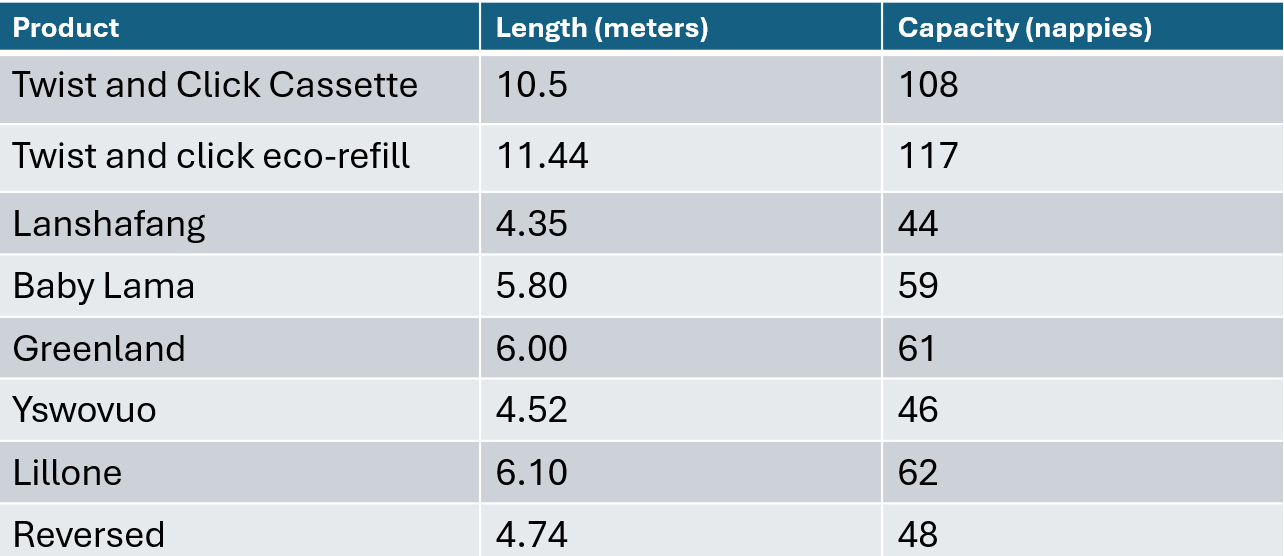

Length: each brand of film measured for length and recorded in table below.

Capacity: each brand of film length was divided by using an average of 9.7cm film per nappy

Conclusion: Twist and Click film was over 50% longer than pre-measured inserts from 8 brands and holds 25% more nappies based on size 1 nappies and length of film.

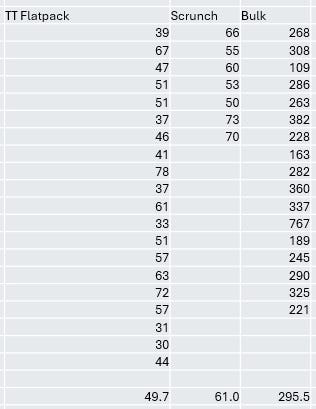

Test date: March 2023

Methodology: 5-10 people timed refilling TT cassette with flatpack, scrunch & bulk film (Bulk film measure 10.5m, cut then fill using tube provided).

Film type that test subjects started with was variated to mitigate bias

Conclusion: Flatpack took on average 49s to refill and was faster compared to prepared and non-prepared refills

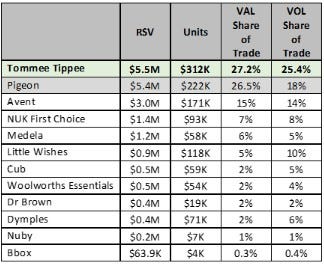

The claim ‘#1 Baby Bottle Brand’ made by Mayborn (UK) Limited trading as Tommee Tippee was validated in the Australia market through bottle value and volume sales data, across all bottle brands, 12 months to 05/01/25

Methodology

Based on value and volume data in major grocery, major pharmacy & Big W, 12 months to 05/01/25, Tommee Tippee are the number 1 baby bottle brand, with a share of 27.2% in value and 25.4% in volume.

This claim is based on third-party market share data from independent data providers, across certain baby product categories in the UK parent-care market, demonstrating Mayborn (UK) Limited trading as Tommee Tippee (“Tommee Tippee”) had a market share over the 12-month period from 11 March 2024 to 10 March 2025 (inclusive) of 21.4%, the highest of any other competitor in the same market for the same product categories during the same period.

For this reason, Tommee Tippee claims to be The UK’s Number 1 Baby Brand.

In making this claim, Tommee Tippee has defined a ‘Baby Brand’ as any parent-care company offering one or more products in all the relevant baby product categories. Market share data relating to such categories has been used to substantiate this claim.

Consumers are encouraged to review the below substantiation to understand the basis on which this claim is made.

Considerations:

Consideration | Response | Commentary |

Third-party data providers |

| Edge and IRI were selected because they cover a broad range of online and brick-and-mortar retailers Edge and IRI are regarded to be reliable within the parent-care sector, and both are independent from Mayborn (UK) Limited and other competitors, thus reducing the risk of bias Two data providers were used to ensure a broad and diverse range of data was sourced to substantiate the claim Tommee Tippee is satisfied the data provided by the third-party data providers allows for an accurate comparison to be made |

Dates | 11 March 2024 to 10 March 2025 (inclusive) | This period was selected to ensure a fair comparison over a reasonable period 12-months is assumed to cover any seasonal or other fluctuations that may impact sales in the relevant baby product categories |

Retailers |

| Online retailers and brick-and-mortar retailers were selected to ensure there was a sufficient number of retailers from a diverse range of environments Consumers should note the data does not include brick-and-mortar sales across all brick-and-mortar retailers in the UK, and it only relates to online sales made via Amazon UK, in both instances according to the data provided by the third-party data providers Online retail does not include sales made via a company’s own website, as this data is not available for all companies and using such data for one company but not another would not allow for an accurate comparison to be made For the avoidance of doubt, the companies referenced in this substantiation have been assessed using the same data (including any limitations in such data) |

Product Categories |

| These baby product categories were selected to provide a comprehensive range of items reasonably considered to be essential, necessary and desirable to parents and children Without exception, each company referenced in this substantiation sells products in the baby product categories referenced in the comparison |

Methodology | Total market share data for the relevant product categories was extracted from Edge and IRI, and combined without adjustment, to demonstrate what company had the highest market share during the relevant 12-month period. | No further commentary |

Ranking | Baby Brand | Market Share (%) |

1 | Tommee Tippee | 21.4 |

2 | MAM | 13.3 |

3 | Own Brand | 5.1 |

4 | Nuby | 4.7 |

5 | Munchkin | 3.0 |

6 | Braun | 3.0 |

7 | Lansinoh | 2.0 |

8 | Medela | 1.9 |

9 | Momcozy | 1.7 |

10 | NUK | 1.4 |